What is a 1031 Exchange?

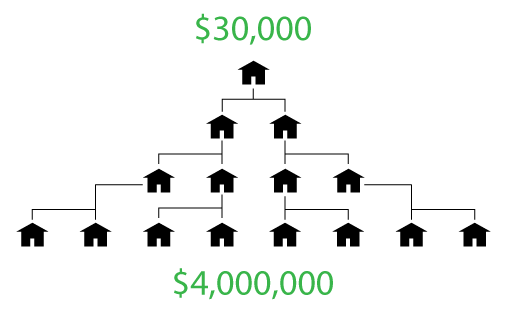

The 1031 Exchange is basically a long-term interest-free loan from the IRS.

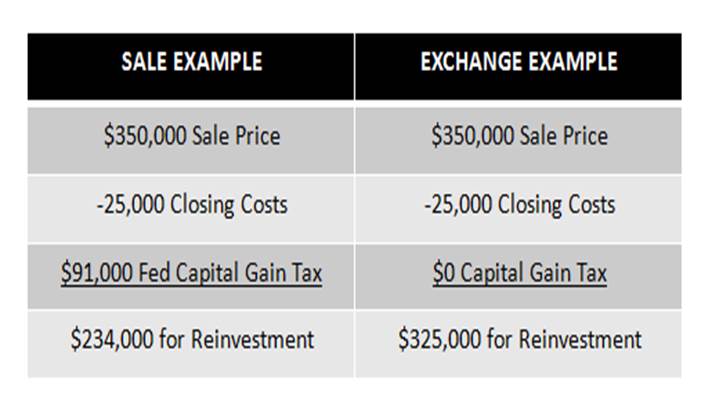

The 1031 Exchange is one of the single GREATEST WEALTH BUILDING tools available to the real estate investor. IRC Section 1031 allows investors to sell a property and reinvest the entire proceeds in a new property without incurring capital gain taxes. IRC Section 1031 is not a tax loop-hole or a tax evasion scheme. Capital gains are merely deferred until the time your proceeds are not reinvested. For specifics on your personal tax situation please contact your accountant or tax advisor.

IRC Section 1031 (a)(1):

“No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment.”

YOU CAN DO THIS!

The 1031 Exchange in Action

How do I get started with a 1031 Exchange?

It all starts with knowledge, planning, and a strategy. A quick conversation can help to determine if a 1031 Exchange is right for you. During our conversation we will assess your financial goals and objectives and discuss your options. If you decide to move forward we will work on your investment strategy and then start identifying investment opportunities if you don’t already have some in mind.